Prioritize things like paying off credit card debt, building an emergency fund and maxing out a Roth IRA.No matter what you want to do with your money, it starts with a budget. Knock Out Debt and Build Your Savingsįinally, use any leftover money in your budget to reach long-term goals faster. Review your spending habits at least once a week to look for patterns and make adjustments to your budget as needed. Here’s our list of the best budgeting apps. There are many ways to record your transactions, from a simple Google Sheets spreadsheet to budgeting apps like Mint and YNAB (You Need a Budget).

The only way to hold yourself accountable is to track your spending over time. (If you need some ideas, refer to Team Clark’s guides to help you make more money and save more money.) 4.

#Budget worksheet free#

“Get your expenses under control, free up some money and then the options start to become more clear about what you do with the money that you’ve managed not to spend.” Don’t overwhelm yourself and look at trying to do everything all at once,” Clark says. “You start where you start and you do building blocks.

#Budget worksheet pdf#

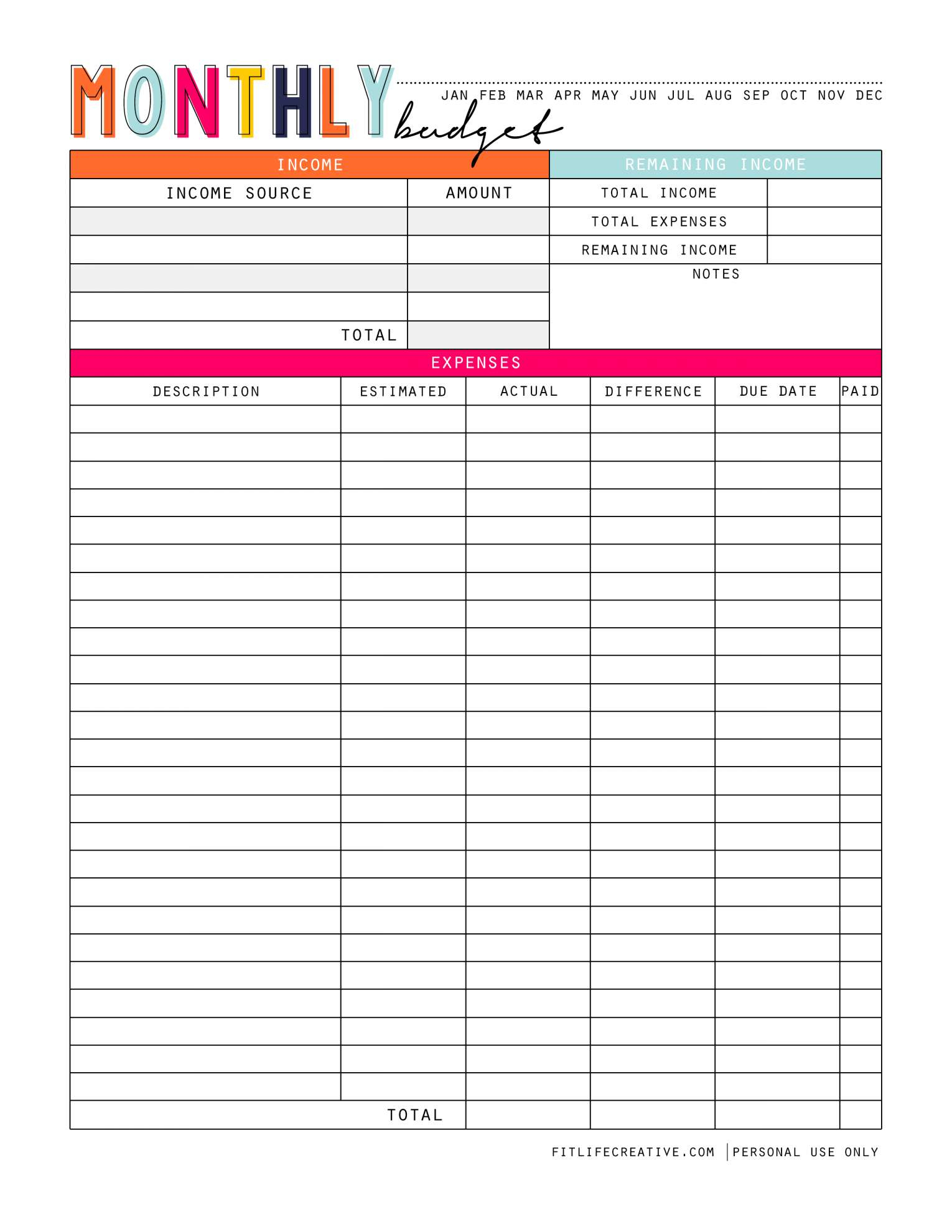

We’ve made this worksheet into an editable PDF so you can customize your budget to track expenses and calculate your savings (or overages) every month.Ĭlick here to download the CLARK Method budget worksheet. If you’re satisfied with spending in a category, mark it as “Looks Good”.Record your actual spending at the end of the month.Highlight “Needs Help” for categories you want to focus on.Plan your spending by setting a dollar amount for each budget category.Using our printable worksheet below, set spending limits for your budget categories and highlight areas where you can cut costs. This step is about setting realistic monthly goals for every budget category. Now that you know how much money is coming in and how much money is going out, plan how you’ll spend your dollars. You also want to budget monthly for annual or semi-annual expenses so that you’re not surprised when those bills are due.įor example, if you pay a $600 auto insurance premium every six months, set aside $100 every month and keep it in a savings account until your next payment.Ĭonsider setting up automatic transfers from your checking account to your savings account for these irregular expenses. Start by going over last month’s statements and recording your bills by budget category: mortgage/rent, groceries, cell phone bill, etc. Next, write down a list of your expenses. Maintaining a budget can help you make sure that your income exceeds your expenses and allows room for retirement savings. This includes your take-home pay (your paycheck after taxes and other deductions) and any other sources of income. The first step is to figure out how much money you’re bringing in every month. Read on to learn about the five steps to a successful budget and download our printable worksheet (PDF file) below to start budgeting the Team Clark way! 1.

To help you get started, remember that budgeting is as simple as C-L-A-R-K:

After the initial setup, it’s really easy and doesn’t take much time. Making a monthly budget for the first time may seem overwhelming, but it doesn’t have to be complicated. This is about giving you power back into your life.” The CLARK Method: 5 Steps to Better Budgeting “Tracking what you’re spending and then seeing where you can make changes in your life is powerful. But the whole idea of budgeting is freeing because you’re getting your life under control, creating more choices and reducing anxiety,” money expert Clark Howard says. “A lot of people look at being told to do a budget as if their life is being restricted. The CLARK Method and our free budget worksheet will put YOU in control of your money: We developed a 5-step plan to help you create a personal budget and stick to it over the long haul. The secret to saving more and spending less every month isn’t a secret at all - it’s a budget.

0 kommentar(er)

0 kommentar(er)